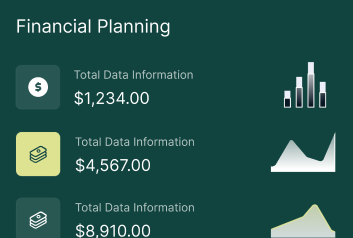

We offer a tiered set of savings options to meet different liquidity and yield preferences: instant-access multi-currency savings accounts for day-to-day needs; high-yield savings pools for longer horizons; and fixed-term deposits with defined maturities and guaranteed nominal returns subject to the issuer's terms.

- Instant-Access Savings: multi-currency, daily interest accrual, real-time statements; ideal for emergency buffers and cash management.

- High-Yield Savings Pools: blended yield products that allocate to conservative yield sources; typically subject to minimum balance and lock-up periods.

- Fixed Term Deposits / Certificates: fixed tenor, fixed nominal rate, scheduled interest payments and clear maturity dates; suitable when you can commit funds for a defined term.

All savings products are subject to KYC and eligibility checks; interest rates are representative and may vary by currency, tenor and jurisdiction.